Recent GDP Report Foretells Troubles Ahead for U.S. Economy

If you believe the U.S. economy could be marching ahead just fine in 2018 and beyond, it may be time to pause and rethink this opinion. The most recent U.S. gross domestic product (GDP) report says headwinds could be ahead.

On Friday, January 26, the U.S. Bureau of Economic Analysis (BEA) reported GDP figures for 2017. It said that the U.S. economy grew 2.3%, versus 1.5% in 2016. (Source: “National Income and Product Accounts Gross Domestic Product: Fourth Quarter and Annual 2017 (Advance Estimate),” Bureau of Economic Analysis, January 26, 2018.)

Investors must remember that GDP is a lagging indicator. The headline figures tell what happened in the past.

One Number That Investors Much Watch Out For

Fortunately, in the entire GDP report, there’s one statistic that’s an indicator of what could be next. And in 2017, it flashed a warning sign that says trouble could be ahead for the U.S. economy.

It’s the private inventories.

What do private inventories tell?

You see, businesses build up inventory in anticipation of demand. If they feel they will be selling more of their products in the coming months and quarters, they start to produce more.

Now, you must be worried if businesses suddenly start to reduce their inventories build. At its core, this says they are expecting a slowdown.

In 2017, we saw businesses in the U.S. economy severely pull back on building up inventories. This shouldn’t be taken lightly, and chances are that the mainstream won’t report about this figure.

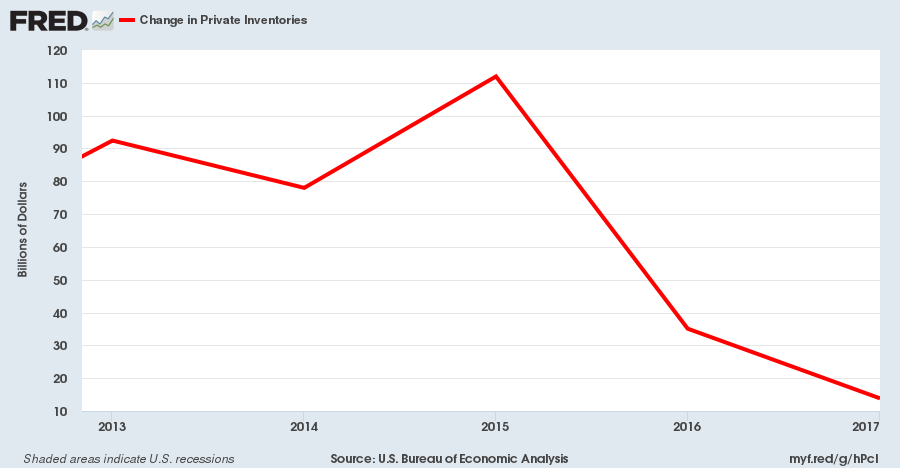

Just look at the chart below. It shows the change in private inventories in the U.S. economy year-over-year.

(Source: “Change In Private Inventories,” Federal Reserve Bank of St. Louis, last accessed January 26, 2018.)

In 2017, private inventories increased by $13.84 billion. In 2016, they grew by $35.07 billion. Go back to 2015 and private inventories in the U.S. jumped by over $111.0 billion. There are seismic shifts currently being ignored.

Let’s do simple math here…

Between 2015 and 2016, private inventories declined by 68.4%.

Between 2016 and 2017, private inventories in the U.S. economy declined by another 60.5%.

U.S. Economy Outlook for 2018 And Beyond

Dear reader, businesses are very clear with their actions; they don’t expect much demand in the coming months and years. They don’t see the U.S. economy growing.

If they even had the slightest hope of increasing demand in 2018 or expecting business to pick up, we would see it with their inventory figures. This did not happen.

Here’s the thing; usually before a recession, inventories start to tumble. Looking at what happened in 2017 with inventories, I can’t help but question if the U.S. economy is headed toward a recession in 2018.

If a recession does become reality this year or the next, let me warn you; it will take a very hard toll on investors’ confidence. They have bought into the idea that the U.S. economy is fine and that nothing could happen to it. Sadly, it’s naïve thinking, but also very dangerous.

Even the slightest hint of a recession could cause them to panic and they could be running for the exits.